Zumo Unveils the Future of Digital Assets at Sibos 2023

Scottish fintech Zumo is at Sibos 2023 in Toronto to unveil a groundbreaking report that’s set to reshape the landscape of digital assets. Titled “Digital Assets 2023: Identifying Opportunities Across the Enterprise Landscape,” this report marks a significant milestone in the journey towards understanding and harnessing the potential of digital assets from an enterprise perspective.

A Pioneering Approach

“Digital Assets 2023” is not just another report; it’s a comprehensive survey, categorisation, and practical analysis of emerging opportunities within the global digital asset ecosystem. It is a deep dive into this nascent sector to uncover the possibilities it offers to businesses worldwide.

The report is backed by fresh insights from some of the biggest names in the digital asset and financial services industries. Collaborators include financial companies like HSBC, NatWest, and Visa, as well as blockchain innovators such as Ripple and Chainalysis. Notably, industry cooperative Swift, the organiser of Sibos, has also played a pivotal role by engaging its global community to explore how financial institutions can seamlessly integrate with the evolving blockchain networks.

A Glimpse into the Future

“Digital Assets 2023” serves as a roadmap for the evolution of blockchain technology from an enterprise perspective. It identifies four pivotal turning points that illustrate the progressive expansion of digital asset applications and participants, starting from the Bitcoin “big bang” moment (often referred to as ‘blockchain 1.0’) and culminating in the current ‘enterprise’ era (‘blockchain 4.0’).

To provide a clear understanding of the digital asset landscape, Zumo has created an enterprise ecosystem map that differentiates between consumer and institutionally-facing solutions, as well as investment versus applied use cases. The report then delves into the opportunities, challenges, and inter-relationships associated with nine specific use cases, categorised as early (institutional digital asset investment, institutional DeFi, web3), developing (tokenization, blockchain in industry, DLT for financial market infrastructure), and established (consumer-facing cryptoasset investment, and individual/business blockchain payments).

Insights from the Author

Daniel Taylor, Zumo’s Research and Policy Lead, and the mastermind behind this report, shared his thoughts on its significance:

“Active learning and knowledge development are integral to Zumo’s mission as a trusted partner for those venturing into the digital asset space. Today marks the dawn of the ‘enterprise’ era, where non-crypto businesses are actively engaging in all four quadrants of digital asset opportunity: consumer, institutional, application, and investment. Our report distills and synthesises these emerging opportunities, providing a comprehensive view of the digital asset and blockchain ecosystem.”

Download Your Copy

Explore the future of digital assets by downloading a complimentary copy of “Digital Assets 2023” at https://zumo.tech/digital-assets-2023/.

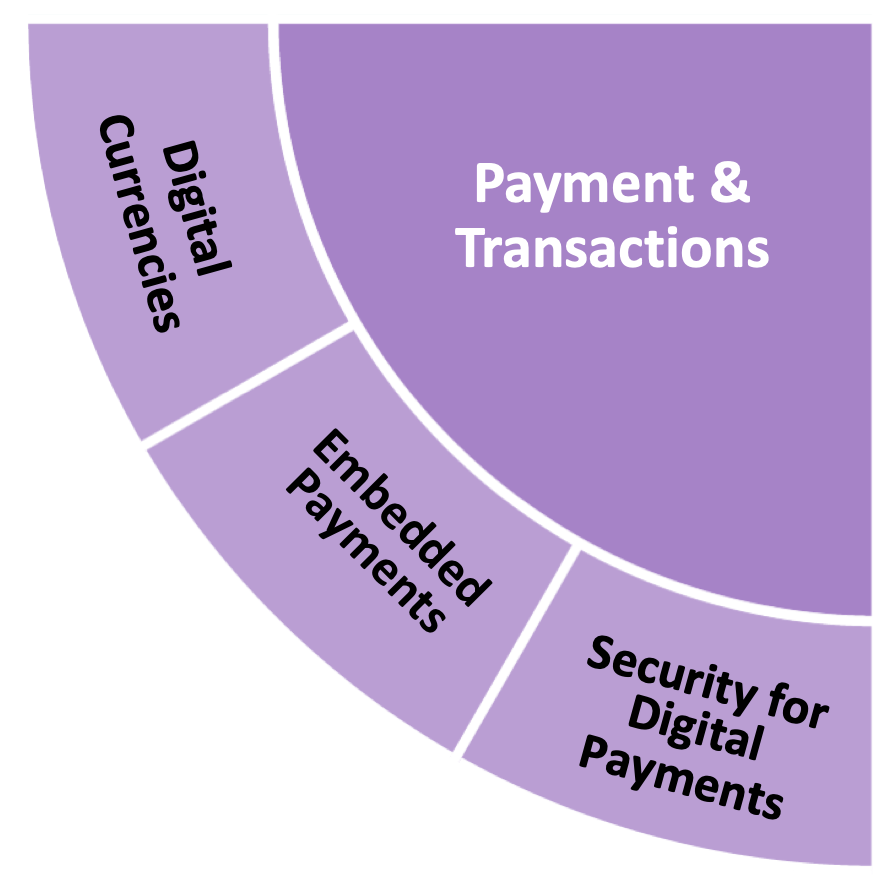

Payments & Transactions, the fintech opportunity

is discussing the key outputs in a series of blogs. This blog focuses on Payments & Transactions, which is one of the four key strategic priority themes.

is discussing the key outputs in a series of blogs. This blog focuses on Payments & Transactions, which is one of the four key strategic priority themes.

The way we pay for things is changing. Throughout the development of the Research & Innovation Roadmap, payments and transactions were referred to in the broad context of the transfer of value (either money, goods, or assets) in exchange for goods and services.

The Roadmap pinpoints the significant move from physical exchanges to digital transactions, and identifies several significant trends that could mean payments will change significantly in years to come. These changes will have a significant impact on the economy, and could also have a substantial impact on citizens and businesses, which is why the future of payments is one of the four priority themes identified.

The importance of Payments & Transactions

The pandemic accelerated the move from physical to digital in many aspects of our lives, including how we make transactions. Customers’ digital expectations and a shift towards more instant electronic payments are having a significant impact on our economy, and a new digital economy is emerging strongly, with major implications for consumers and SMEs alike.

Across the development of the Roadmap, when looking at the theme of the future payments we considered the topic of digital currencies and crypto currencies. These innovations present new ways for value to be stored and exchanged. It is clear there is a still a lot to learn about the potential, the impact, and the implications of cryptocurrencies as a method for mainstream payments. Stablecoin is a form of cryptocurrency that is linked to an asset that is stable in value, and stablecoins are generating significant interest for future payments and value exchange.

The UK Government has established a crypto assets taskforce, and the UK regulators are considering the benefits and risks on a range of issues connected to this topic, including a separate digital currency backed by a central bank. Since the publication of the Roadmap, HM Treasury has confirmed its commitment to the development of appropriate regulation for crypto.

As we further explored the payments theme, we identified technologies of particular interest, such as AI, blockchain and distributed ledger tools. Industry expressed interest about how these technologies could offer a completely different way to organise and manage payment systems, providing a route to real-time, cross-border payments worldwide. These developments pave the way for a potentially very different future of value exchange. According to the World Economic Forum, up to 10% of global GDP could be stored on blockchains by 2025.

Embedded payments is one of the hottest topics in FinTech in 2022, and was another area of particular focus. Technology is advancing the methods to embed payments in everyday experiences and allow customers and businesses to pay for purchases without entering bank details, credit, or debit card information.

Historically, the payments process has lived at the edges of experience for businesses. Payments were either taken in cash, or offline, with no real lasting insights into the customer and the goods or services they purchased. Technology businesses are now fully embedding software that enables a change to this experience, creating more choice and allowing businesses to have a deeper connection with customers. In addition to high profile examples such as Uber, many embedded payment innovations are emerging, such as in-car payments, smart fridges and connected homes.

Priority areas in Payments & Transactions

The industry contributors to this roadmap offered a view that the future looks set for significantly more change. Our analysis highlighted three topics of interest:

Digital currencies

- Cryptocurrencies and stablecoins

- Distributed ledger technology

Embedded payments

- SME market

- Retail consumers

Security for digital payments

- Cyber security

- Biometrics

Roadmap next steps: Payments & Transactions

A range of proposed next steps are laid out in the published Roadmap, which specifically identifies 10 actions relating to Payments & Transactions, and categorises each into one of three phases over the next 10 years. These actions are illustrated in the graphic below. The report also references 23 different stakeholders who can support the implementation of these actions, which are broken down into research projects and innovation calls.

More information about FinTech Scotland’s Research & Innovation Roadmap can be found here, where the full Roadmap can also be downloaded.