On-Land Payment Infrastructure for Rapid Growth

A strong infrastructure is a foundation for every sustainable financial business. The payment acceptance space is massively regulated by the Payment Card Industry (PCI) and payment schemes (VISA, Mastercard, AMEX, etc.). At Paymob, we decided to take over a heavy part of the payment space – backend infrastructure. We are a software development company focused on b2b enterprise solutions. For the last ten years, Paymob Group managed to develop a proprietary infrastructure for on-land payments, professionally called EFTPOS (Electronic Funds Transfer at Point-of-Sale). We exist to help other fintech and banking initiatives to launch rapidly and grow fast with unbeatably scalable Paymob’s technologies under the hood.

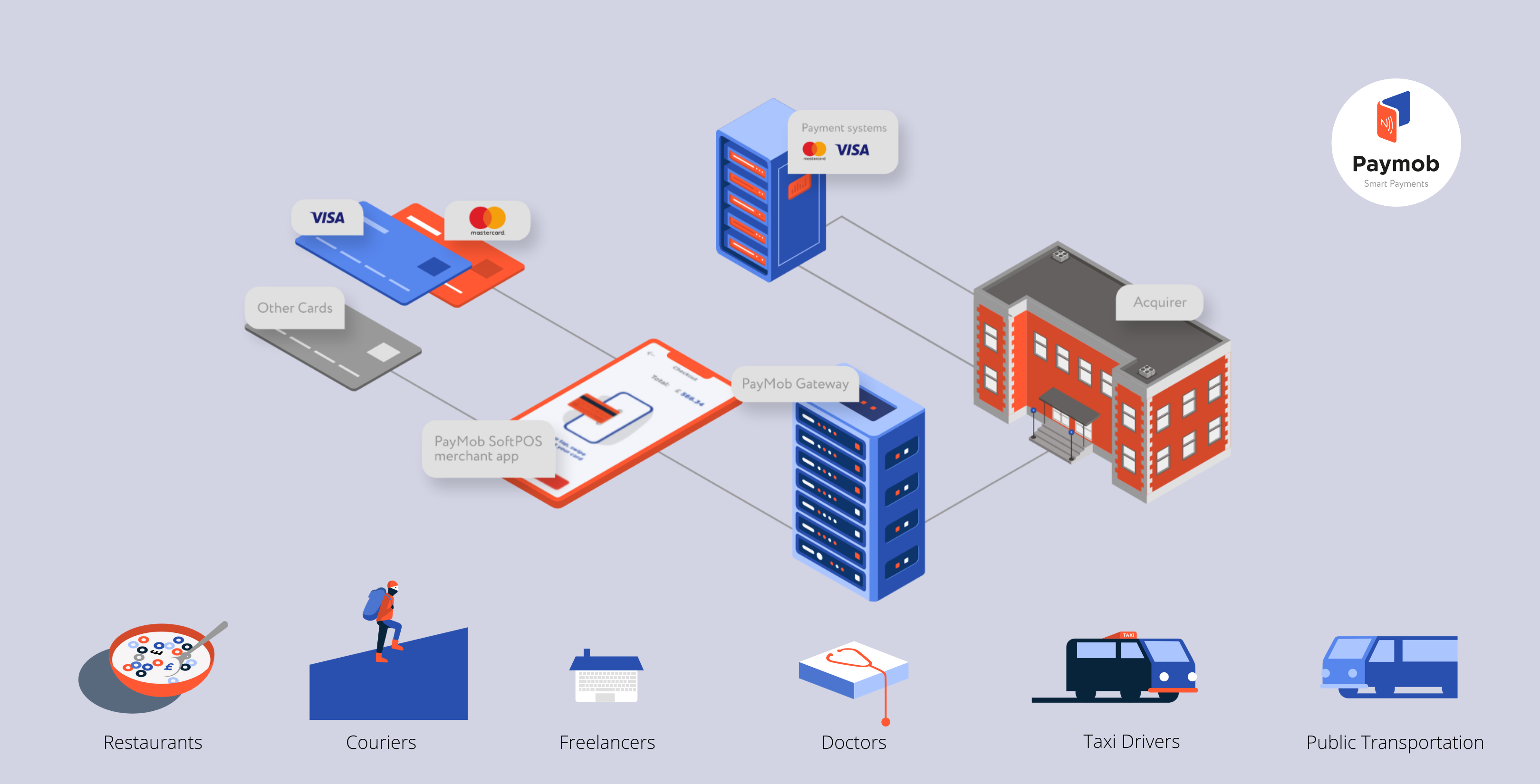

The solution we have got covers the whole card-present payment flow, starting from a till delivering the transaction to the schemes. The bespoke payment interfaces include either a traditional card machine or smart Android-based smart POS terminal or even our in-house developed mobile application that turns a smartphone into a contactless payment terminal. Our core innovation is server-based software that sits between a payment terminal and processors. The core might be an independent payment processing solution as well as an extension of any existing banking infrastructure with hassle-free integration to the latter. Paymob offers a full white-label technology to banks and other fintech businesses. Sberbank, one of the biggest acquiring banks on the planet, is our client. Number one and number three biggest banks in Kazakhstan are our customers among tens of others. In total, the solution is in use by 27 banks in 9 countries around the globe. The tech serves almost a half million of traditional card machines and smart POS terminals.

Paymob has to offer a proprietary EFTPOS system cloud version or in-house deployment. The system might be easily white-labelled, and it includes a TMS (Terminal Management System), Merchant Portal, Payment Switch and other essential functionality. Let me dig in details into a term the Payment Switch. This is a crucial component when a single payment terminal via the Paymob EFTPOS system may be connected to several processing centres at the same time. Depends on which card is presented at the terminal (domestic or international, business or individual, credit or debit) the Payment Switch knows exact transaction fees at every processing centre (bank acquirer) it connected with to navigate the transaction to the cheapest provider to save the cost of the transaction. As well, this feature means an opportunity to connect to national or particular payment systems like some regional QR or bar-code payment systems.

The industry-disruptive piece of our solution is Paymob’s core EFTPOS system. Traditionally a card machine connects directly to a processing centre. Meaning each piece of data will be delayed and sometimes even not accessible at all by stakeholders. Instead, at Paymob, we embedded our core tech in-between of the terminal and processing centre. It puts us at a position to control and route every transaction without breaking the industry regulations. At the same time, our disruptive attitude put us in a position to introduce even more advanced approach. Actual stage of software penetration and almost unlimited possibilities made us able to establish a far beyond idea of an ecosystem where payment acceptance is just one out of hundreds of different features on the same payment terminal. Direct integration with accounting solutions and different ePOS till systems for immediate reconciliation might be done via Paymob’s powerful API engine. Paymob’s Terminal today accepts almost all available payment types. Every payment interface we offer is an access point to a variety of added-value services and provides a full marketplace of other applications.

Good examples of these applications might be a few cases. Taxi ordering app on the same smart terminal may be used at a restaurant to order a taxi for guests. In this case, the taxi service pays a commission to the restaurant and terminal provider. Proper insurance policies might be offered at a bicycle store to its clients, when, again, the insurance provider pays a premium to the shop and the terminal provider. Virtual ATM for the cash-ins and outs, money transfer services, selling or buying cryptocurrencies are other applications to be easily deployed on the terminals. These are only use cases on a surface to be considered as added value services within Paymob’s Ecosystem philosophy.

The latest achievement worth to mention is the most advanced payment interface called Soft POS (Software Point-of-Sale) or Tap To Phone. This is an Android mobile application that turns almost any modern smartphone into a contactless payment terminal. We spent years and a vast volume of resources to certify our in-house developed technology at major payment schemes. Today Paymob is ready to supply the solution on a global scale as an approved vendor. The technology is cutting-edge and disruptive. It drives emerging markets and micro-preneurial economies towards cashless payments. It introduces a zero-cost and extremely rapid process for new merchants onboarding. It revolutionises the whole payment acceptance industry.

We believe in our invention to a degree that we chose one of the most advanced and competitive financial markets in the world, the UK, to launch own payment company and win local businesses. Recently, we obtained a payment institution license from the regulatory authority and going to introduce a whole range of our technologies directly to UK merchants.