Navigating Double Materiality in ESG: Practical Steps for Businesses

Introduction to Double Materiality

Double materiality emerged as a concept relatively recently, but has been gaining interest as a practical, actionable conceptualization of ESG outputs. Materiality itself traditionally focused on how a factor impacted firm financial performance, a decidedly unidirectional approach. Double materiality looks to identify both the financial materiality of an issue as well as the impact materiality, which assess the material impact upon society and the environment. Rising stakeholder demands and regulatory pressures are making double materiality more and more prevalent in today’s business climate. To practically navigate double materiality, companies must adopt comprehensive strategies that integrate both financial and societal/environmental dimensions into their decision-making processes.

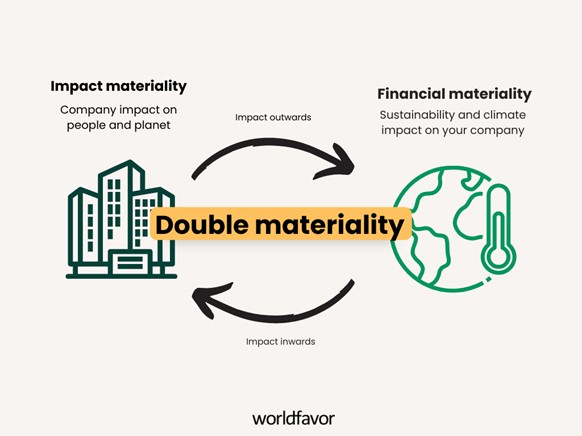

The EU Commission’s Supplementary Directive 2013/34/EU states, “…double materiality as the basis for sustainability disclosures”. The two dimensions of double materiality, impact and financial, are further noted as being ‘…inter-related and the interdependencies between these two dimensions shall be considered” (section 3.3). This is best visualized in the following graphic:

Image credits: Worldfavor, July 2023

As shown, the assessment impact or financial materiality are interconnected and mutually reinforcing. The impacts are, from a company perspective, split between impact inwards and impact outwards, meaning the materiality of an issue as it impacts the company itself (impact inwards) and the material impact of a company’s actions on society and the environment (impact outwards). In today’s reporting climate, those two directions are seen as more closely related than ever before.

In industries such as Aerospace, the concept of materiality is closely linked to innovation. Companies like SpaceX, Orbex, or Collins Aerospace have defined themselves as organisations with a sustainability element. This is a clear demonstration of the circular nature of double materiality, in that the impact materiality (the firm’s sustainability efforts) are directly impacting the financial materiality (inwards impact in the form of sales and customers, outwards impact in the form of environmental innovation and positive social investment) and vice versa. For instance, when discussing potential environmental impacts of manufacturing for aerospace and defense technologies, S&P Global argued that the climate transition would be significantly material for stakeholders as manufacturing and transportation emissions require long-term strategic planning but is less likely to impact near-term credit (S&P Global, 2022).

In defining impacts, it is important to note that risk and opportunities are both components of impact, but that they are not necessarily the entirety of the impact. For instance, an environmental impact may become financially material due to changing weather patterns. Conversely, a financial issue may develop impact materiality through a change in regulations or soft law pressures.

Practical Steps for Businesses

To effectively navigate double materiality, businesses need to implement a series of practical steps, encompassing governance, stakeholder engagement, data collection, and reporting.

1. Establish Strong Governance Frameworks

Leadership and Oversight: Establish a governance framework that includes oversight by the board of directors or a dedicated ESG committee. This structure should ensure that double materiality is integrated into the company’s strategic objectives.

Roles and Responsibilities: Clearly define roles and responsibilities for ESG initiatives across various departments, with a defined company-wide strategy to ensure efficiency of data collection and reporting. Assign senior executives to oversee both financial and impact materiality aspects, ensuring alignment with the company’s overall strategy.

2. Engage Stakeholders

Identifying Stakeholders: Identify and actively engage with key stakeholders, including investors, employees, customers, suppliers, regulators, and local communities. Understanding their concerns and expectations is vital for addressing both financial and impact materiality.

Dialogue and Collaboration: Engage in open and continuous dialogue with stakeholders through surveys, meetings, and advisory panels. Collaboration with stakeholders helps in identifying material ESG issues that are relevant from both financial and impact perspectives.

3. Conduct Materiality Assessments

Materiality Matrix: Develop a materiality matrix that plots ESG issues based on their importance to stakeholders (impact materiality) and their potential financial impact on the company (financial materiality). This visual tool helps prioritize ESG issues that require attention.

Dynamic Assessments: Conduct regular materiality assessments to adapt to evolving ESG landscapes and stakeholder expectations. This ensures that the company remains responsive to new challenges and opportunities.

4. Integrate ESG into Risk Management

Risk Identification: Identify ESG-related risks that could affect the company’s financial performance and societal impact. This includes environmental risks (e.g., climate change), social risks (e.g., labor practices), and governance risks (e.g., corruption).

Risk Mitigation: Develop and implement strategies to mitigate identified risks. This might involve adopting sustainable practices, improving supply chain transparency, or enhancing corporate governance standards.

5. Develop Robust Data Collection and Reporting Mechanisms

Data Collection Systems: Implement robust data collection systems to gather accurate and reliable ESG data. Use technology solutions like IoT, blockchain, and AI to enhance data accuracy and transparency.

Reporting Standards: Align reporting with established frameworks such as the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD). These frameworks provide guidelines for comprehensive and comparable ESG reporting.

Integrated Reporting: Consider adopting integrated reporting, which combines financial and ESG information into a single report. This approach provides a holistic view of the company’s performance and its impacts, enhancing transparency and accountability.

6. Foster a Culture of Sustainability

Employee Engagement: Educate and engage employees at all levels about the importance of double materiality and sustainable practices. Encourage employees to contribute ideas and initiatives that promote sustainability.

Incentives and Recognition: Establish incentive programs to reward employees for their contributions to ESG goals. Recognize and celebrate achievements in sustainability to reinforce the company’s commitment to double materiality.

Challenges and Solutions

Data Complexity

In speaking to any ESG practitioner, one of the first challenges to arise is data collection. The data itself is often spread throughout a company, does not fit neatly into easily-organised spreadsheets, or may be difficult to understand in differing contexts (i.e. data from suppliers regarding their carbon emissions may not be shared in the format required by reporting standards).

To address this, companies can invest in advanced data management tools, third party support or automation systems, and design internal systems for data collection. It will be an investment of time and personnel but is also likely to be regulated and required in the near future.

Stakeholder Alignment

Particularly in industries with heavy manufacturing or extractive practices, it may be difficult to align stakeholder interests in a manner that is socially and environmentally material, without sacrificing financial performance. Engaging with stakeholders and third-party expertise while seeking innovative solutions and long-term strategic planning allows companies to effectively address ESG concerns.

Conclusion

Navigating double materiality requires a strategic and integrated approach that aligns financial performance with societal and environmental impacts. By establishing robust governance frameworks, actively engaging stakeholders, conducting dynamic materiality assessments, integrating ESG into risk management, developing comprehensive reporting mechanisms, and fostering a culture of sustainability, companies can effectively integrate double materiality. Success in this area not only enhances corporate reputation and stakeholder trust but also drives long-term value creation in an increasingly sustainability-focused world.

Resources

Boeke, E., York, B. N., London, D. M., Tsocanos, B., York, N., & Paris, P. G. (2022). Sustainable Finance Credit Ratings ESG Materiality Map Aerospace And Defense.

Commission Delegated Regulation (EU) 2023/2772 of 31 July 2023 supplementing Directive 2013/34/EU of the European Parliament and of the Council as regards sustainability reporting standards, (2023).

Sean Michael Kerner. (2024, April). Double Materiality. Https://Www.Techtarget.Com/Whatis/Definition/Double-Materiality#:~:Text=Double%20materiality%20acknowledges%20risks%20and,Environment%20and%20society%20at%20large.

S&P Global. (n.d.). Materiality Mapping: Providing Insights Into The Relative Materiality Of ESG Factors https://www.spglobal.com/esg/insights/featured/special-editorial/materiality-mapping-providing-insights-into-the-relative-materiality-of-esg-factors

Worldfavor. (2023, July). CSRD: what is the double materiality assessment? Https://Blog.Worldfavor.Com/Csrd-What-Is-the-Double-Materiality-Assessment.