It’s worse than that”¦ Jim

Anthony Rafferty, Managing Director, Origo says recent research into integration between systems in financial adviser firms’ back-office systems reveals a worrying disconnect eating into time, resource and profits of businesses

Origo recently commissioned in-depth research into the integration between systems in the back-offices of financial advice firms, and how this affected the efficiencies and profitability of those firms.

The research was carried out independently by the lang cat, a specialist financial services consultancy based in Edinburgh, and combined hours spent in financial advice firms around the UK mapping processes and analysing how they use the systems they have in place, as well as conducting online research with another 116 financial advice firms.

The conclusion is best summed up by Mark Polson, the MD of the lang cat, who was heavily involved in the research. He says: “We knew things weren’t great before we set out to conduct this research. But even so, we were struck by the impact of these inefficiencies on adviser back offices. Even where integrations do exist, firms aren’t trusting them or using them ”“ with good reason in some cases.”

From closely studying firms’ processes, the research estimates that in a typical financial advice business, staff could be up to 100% more efficient, dealing with twice the assets under administration they currently manage, if the systems they used were properly integrated with one another. In other words, staff could potentially be dealing with up to twice the number of fee paying clients than they are at the moment.

That is both a shocking state of affairs and also one of opportunity ”“ not least for financial advice firms.

To explain what we found: Firms involved in the study on average used five standalone systems in the process of giving advice, building investment and savings portfolios and managing clients; seven when platforms (transaction and administration services) were added; 10 with the addition of more general systems like accounting and office software.

It showed that due to a lack of integration between systems, and trust in those systems, firms are having to plough time and money into otherwise unnecessary manual input and reconciliation. In a typical new business journey, for example, client details were being keyed into systems at least three times!

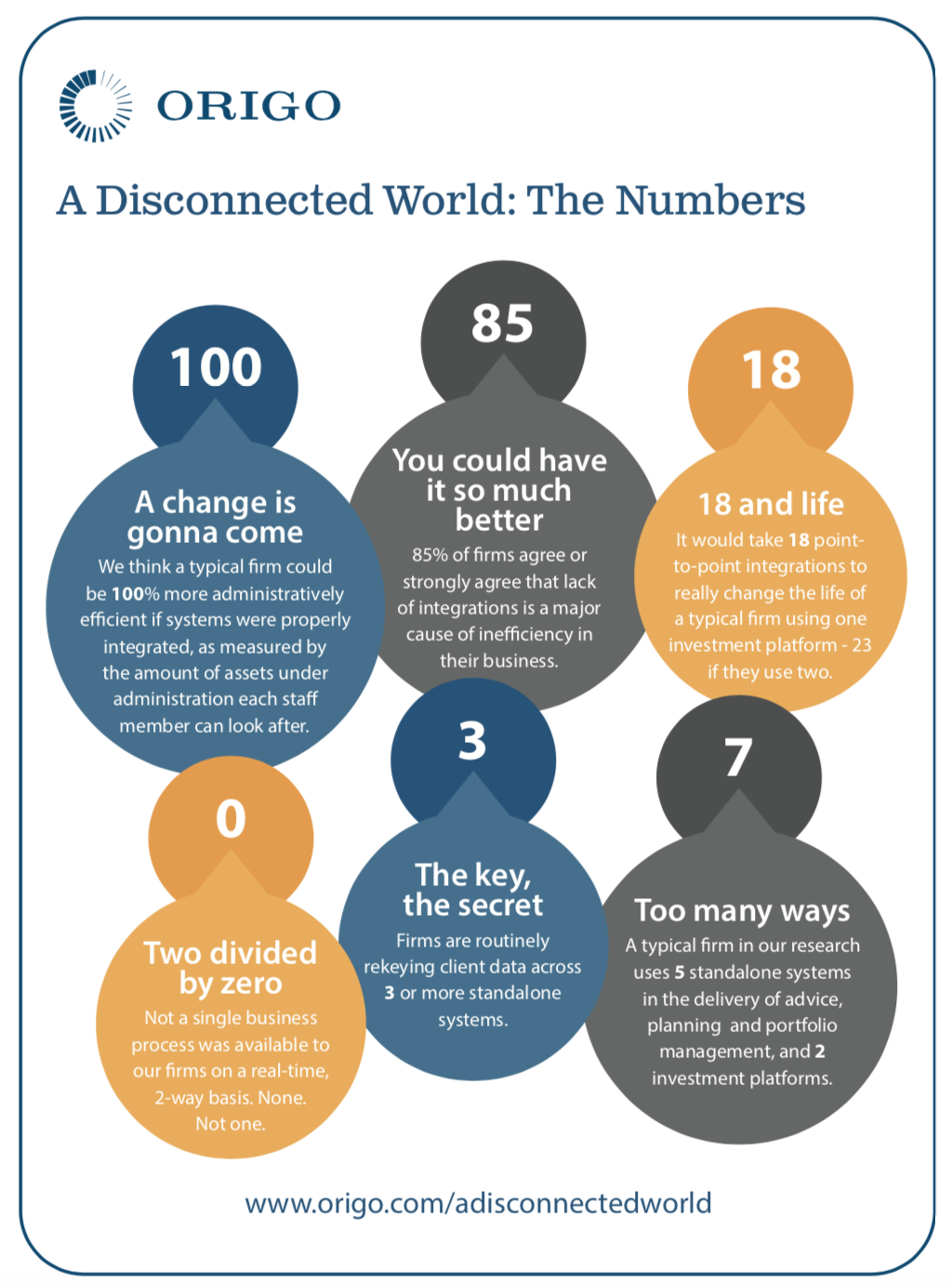

Key facts from the research can be found on the accompanying infographic.

Currently ”“ and to be fair, despite sterling work by some of the players in the market ”“ advice firms do not benefit from a level of integration that is of real use to them. Integrations are typically point-to-point, with one provider integrating with another for specific purposes, for example for portfolio valuations.

They are also driven by business case, with platforms, CRMs and other system providers naturally prioritising integrations that will bring in higher levels of returns.

On a practical level and worryingly, even where integrations exist, adviser firms said that the lack of consistent and quality data meant they distrusted the output the systems are delivering, the result of which was that they had reverted to inefficient, costly and potentially risk inducing manual processes, because it was a process over which they have more control.

Typically there are 23 point-to-point integrations required within a firm using two investment and savings platforms, without factoring in any systems for protection and mortgage services and general office systems. On a point-to-point basis, that level of integration is never going to happen.

But there is a solution. We identified that if there was a centralised hub, into which platforms, CRMs and adviser software systems and tools could integrate once and then connect to every other player in the market who was also connected to the hub, and which also dealt with making and maintaining the connections, the benefit to the industry could be huge ”“ in particular to the financial adviser firms.

Using a centralised hub would mean any provider new or established could connect with any other provider on the hub, for services pertinent to their operations, no matter the volume of business.

In this way, a centralised integration capability would significantly improve the market’s connectivity, helping advice firms to improve their efficiencies, their profitability and enabling them to deliver faster and better service to their clients, whilst potentially boosting business across the board.

Hence, for the past couple of years we have been building the Origo Integration Hub to help provide that solution.

From a business perspective, for systems and services providers, this hub-and-spoke approach to integration does away with the need for case-by-case decisions and resource restraints incumbent of the point-to-point integration method. Linking to a hub incurs one set of integration costs instead of many, and significantly reduces resource and IT costs, which platforms and system suppliers can better apply elsewhere in their business.

Importantly, it provides the opportunity for all software and service companies, including smaller companies and new entrants, to easily connect with new trading partners if they wish. Also, it enables adviser firms to use the software or service that best suits their business set-up.

Currently, the Integration Hub has 19 companies including some of the big names in investment and savings signed to it, with others in the pipeline.

From a top down perspective it seems illogical that in the 21st century systems do not talk to one another in an efficient manner. However, this is a legacy issue which Origo with its remit to help improve the efficiencies and cost effectiveness of the industry and deliver better outcomes for consumers, is in a position to help resolve.

Read more about Origo here