LendInvest is the UK’s leading technology driven asset management platform for property finance, and is listed on the London Stock Exchange (LINV).

We offer short-term, development and buy-to-let mortgages. Its proprietary technology and user experience are designed to make it simpler for both borrowers and investors to access property finance.

Since inception we have lent more than £4 billion in mortgage finance and have helped to put thousands of new and improved homes into the UK housing market. In that time we’ve built a truly international capital base. Today, our funders and investors include pension funds, insurers and global institutions including HSBC, J.P. Morgan, Citigroup and National Australia Bank.

We are driven by our mission to harness technology and the ambition of our team to build the platform of choice for our investors, financial partners, borrowers, and intermediaries with the aim of making property finance simple.

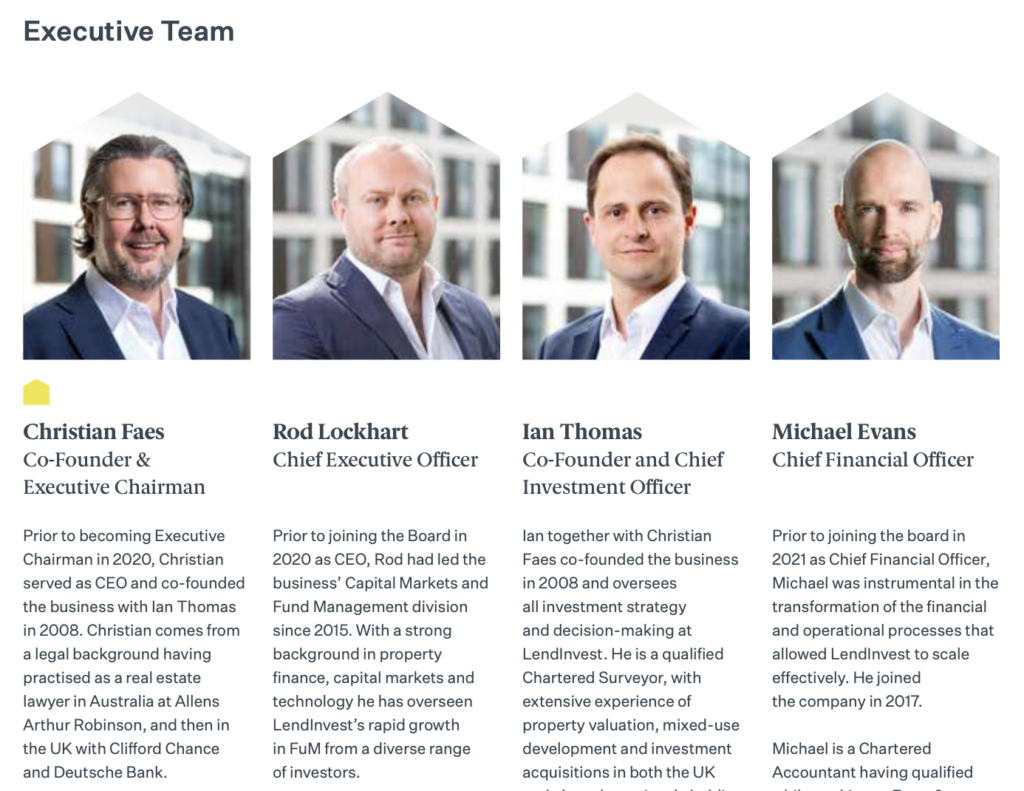

2008 – As global financial markets crashed, our founders, Christian Faes and Ian Thomas, saw an opportunity to fill a critical gap in short-term property finance. They launched Montello Bridging Finance, an offline bridging finance lender and the forerunner to LendInvest.

2012- Saw the opportunity to begin building our own technology and take our proposition online as we managed £30 million of investors’ capital.

2013- Launched our online investment platform and LendInvest was born.

2015 – Surpassed £300 million of completed loans. Received the highest rating for loan servicing from ARC Ratings for the first time (a feat repeated every year since). Launched Development Finance.

2016 – Broke through the £500 million funding milestone. Secured £17m Series B funding from Atomico.

2017 – Listed the first ever Fintech retail bond programme on the London Stock Exchange. Launched Buy-to-Let loans with backing from Citigroup.

2018 – Raised £30.5 million in Series C fundraising. Joined the Luxembourg House of Financial Technology (LHoFT).

2019 – Completed the UK’s first Fintech securitisation (£259m of Buy-to-Let loans). Agreed two new £200 million funding lines with HSBC and National Australia Bank. Launched Open Banking for borrowers and brokers.

2020 – Launched Regulated Bridging, our first fully end-to-end online product. Surpassed £3 billion of originations and launched our first green finance offer. Completed our second securitisation of Buy-to-Let loans, nine months after the first.

2021 – Listed as a publicly traded company on the London Stock exchange, completed our third securitisation of Buy-to-Let Loans and launched our first Green mortgage suite.